Articles & Updates

Some of these measures impact Your Self-Managed Superannuation Fund (SMSF) and the related audit requirements.

In addition, the ATO has introduced new requirements in the determination and documentation of your SMSF’s investment strategy.

We have prepared a document, listing what the audit & ATO requirements pertaining to those measures are for the FY 2020 and future audits.

Please click here to view the updates to SMSF audit requirements.

We believe that with the help of this document, you will be able to gain a better understanding of what will need to be prepared and provide as additional documents for the auditors.

The Next Steps are:

- In the next week or so we will send you a questionnaire covering all of the points in the attached list which will determine what is and is not relevant to your SMSF.

- On getting this back we will then prepare an action check list of what needs to be done for your SMSF to comply.

The auditors have expressed that pre-preparing the required documents will reduce the queries they will have on a job and the turnaround time of the audit job itself.

Looking forward to your continued support and to continue working with you.

For more resources, information and articles on COVID-19, please visit the dedicated COVID-19 page on our website by clicking here and like us on Facebook today to receive regular updates.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

Please click here to find a checklist as a guide for you to review as we continue to work through these challenging times.

Safe Work Australia COVID-19 Information for Workplaces

National COVID-19 Safe Workplace Principles

Risk Assessment Considerations

https://www.safeworkaustralia.gov.au/doc/key-considerations-undertaking-risk-assessment-covid-19

Risk Assessment Template

https://www.safeworkaustralia.gov.au/doc/template-and-example-covid-19-risk-register

Checklists (Workplace/Physical Distancing/Cleaning/Health, Hygiene & Facilities)

https://www.safeworkaustralia.gov.au/collection/workplace-checklists-covid-19

Cleaning & Disinfecting your Workplace

https://www.safeworkaustralia.gov.au/doc/how-clean-and-disinfect-your-workplace-covid-19

Signage & Posters

https://www.safeworkaustralia.gov.au/doc/signage-and-posters-covid-19

COVID-19 Resource Kit

https://www.safeworkaustralia.gov.au/collection/covid-19-resource-kit

COVID-19 Information for Workplaces

https://www.safeworkaustralia.gov.au/covid-19-information-workplaces

For more resources, information and articles on COVID-19, please visit the dedicated COVID-19 page on our website by clicking here and like us on Facebook today to receive regular updates.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

The Chief Medical Officer, Professor Brendan Murphy provided an update on the measures underway, the latest data and medical advice in relation to COVID-19.

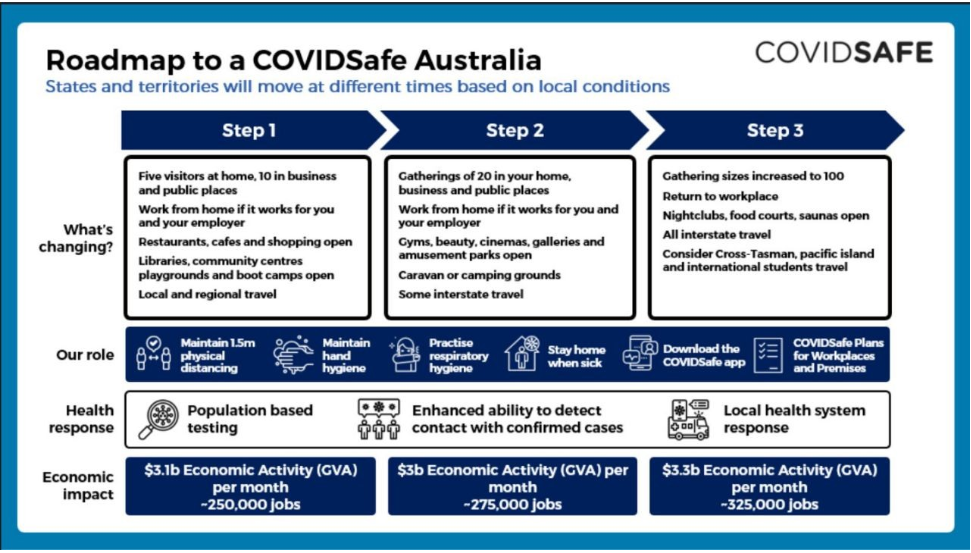

PM, Scott Morrison announced a three-step plan (image below) to put Australia back on the road to recovery from Coronavirus. It will be to the discretion of each state to implement each step and when with the plan to have all steps in action by mid-July.

- Step 1 will focus on carefully reopening the economy, and giving Australians opportunities to return to work and social activities, including gatherings of up to 10 people, up to 5 visitors in the family home and some local and regional travel

- Step 2 builds on this with gatherings of up to 20, and more businesses reopening, including gyms, beauty services and entertainment venues like galleries and cinemas.

- Step 3 will see a transition to COVID safe ways of living and working, with gatherings of up to 100 people permitted. Arrangements under step 3 will be the ‘new normal’ while the virus remains a threat. International travel and mass gatherings over 100 people will remain restricted.

By state:

NSW – Preparing to ease some stage one restrictions Friday 15th May 2020.

For more resources, information and articles on COVID-19, please visit the dedicated COVID-19 page on our website by clicking here and like us on Facebook today to receive regular updates.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

If you enrol by 31 May you will still be able to claim for the fortnights in April and May, provided you meet all the eligibility requirements for each of those fortnights. This includes having paid your employees by the appropriate date for each fortnight.

For the first two fortnights (30 March – 12 April, 13 April – 26 April), we will accept the minimum $1,500 payment for each fortnight has been paid by you even if it has been paid late, provided it is paid by 8 May 2020. If you do not pay your staff by this date, you will not be able to claim JobKeeper for the first two fortnights.

You can enrol and claim for JobKeeper earlier if you choose. For example, you can enrol by the end of April to claim JobKeeper payments for the two fortnights in April.

For more resources, information and articles on COVID-19, please visit the dedicated COVID-19 page on our website by clicking here and like us on Facebook today to receive regular updates.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

For more resources, information and articles on COVID-19, please visit the dedicated COVID-19 page on our website by clicking here and like us on Facebook today to receive regular updates.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

WHEN DOES AN ALTERNATIVE TESTS APPLY?

- You commenced business after the relevant comparison period

- You acquired or disposed of part of your business after the relevant comparison period

- You undertook a restructure after the relevant comparison

- Your turnover substantially increased immediately prior to the relevant period.

- Your business was affected by declared natural disasters during the relevant comparison period.

- Your business has a large irregular cyclical or seasonal variance in turnover before the applicable turnover test period

- Where sickness, injury or leave has impacted your ability to work in your business which has, in turn, affected turnover.

WHAT ARE THE IMPLICATIONS FOR YOUR JOBKEEPER ELIGIBILITY?

To access JobKeeper payments, your small to medium business must pass the turnover test – showing you’ve seen a decline in revenue of at least 30% to a comparable period.

The alternative test grants businesses different ways of proving a decline in revenue of at least 30% to a comparable period. This potentially opening the wage subsidy up to a new group of businesses who were not previously eligible.

FURTHER INFORMATION

For more detail, email Info@journey2.com.au or call 02 42284877

For more resources, information and articles on COVID-19, please visit the dedicated COVID-19 page on our website by clicking here and like us on Facebook today to receive regular updates.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

To assist our clients, we have prepared the following tables which briefly summarise some of the key initiatives announced by each State and Territory Government as at the time of writing.

WARNING – Using the information provided

The tables in the above referenced “Australian State & Territory Economic Relief & Stimulus Package Summmaries” have been compiled from information that was available from the relevant State and Territory revenue office and Government websites as at 17 April 2020 and is subject to constant change as further initiatives are announced.

Please note that the information contained in these tables is intended to provide a broad overview of the key initiatives for each State and Territory (as announced at the time of writing). The information should not be relied upon as advice and should be used as a guide only.

Anyone wishing to rely on the information presented in these tables, should undertake their own checks with the relevant State or Territory authorities, together with any supporting legislation or regulations, or seek specialist advice where necessary, for specific details of the various measures (including eligibility requirements) and to keep abreast of developments

For more resources, information and articles on COVID-19, please visit the dedicated COVID-19 page on our website by clicking here and like us on Facebook today to receive regular updates.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

Summary

The Government is supporting small business to retain their apprentices and trainees. Eligible employers can apply for a wage subsidy of 50 per cent of the apprentice’s or trainee’s wage paid during the 9 months from 1 January 2020 to 30 September 2020. Where a small business is not able to retain an apprentice, the subsidy will be available to a new employer. Employers will be reimbursed up to a maximum of $21,000 per eligible apprentice or trainee ($7,000 per quarter). Support will also be provided to the National Apprentice Employment Network, the peak national body representing Group Training Organisations, to co-ordinate the re-employment of displaced apprentices and trainees throughout their network of host employers across Australia.

Eligibility

The subsidy will be available to small businesses employing fewer than 20 employees who retain an apprentice or trainee. The apprentice or trainee must have been in training with a small business as at 1 March 2020. An eligible apprentice is a person employed in an Australian Apprenticeship at the Certificate II level or above with a Training contract formally approved by the state training authority.

Employers of any size and Group Training Organisations (GTO) that re-engage an eligible out-of-trade apprentice or trainee will be eligible for the subsidy. If you host apprentices through a GTO, the GTO will apply for the wage subsidy. Your GTO will receive the reimbursement and they must pass this on to you. The first reimbursement to you will be half of the wages paid to the apprentice (not half of what you paid to the GTO).

Employers will be able to access the subsidy after an eligibility assessment is undertaken by an Australian Apprenticeship Support Network (AASN) provider. This measure will support up to 70,000 small businesses, employing around 117,000 apprentices.

Timing

Employers can register for the subsidy from early April 2020. Final claims for payment must be lodged by 31 December 2020.

For further information on how to apply for the subsidy, including information on eligibility, contact an Australian Apprenticeship Support Network (AASN) provider.

Budget impact This measure is expected to cost $1.3 billion across 2019-20 and 2020-21.

Note:

You cannot claim both Apprentice Wage Subsidy and JobKeeper Payment at the same time. However you can claim one and then transfer to the other.

For more resources, information and articles on COVID-19, please visit the dedicated COVID-19 page on our website by clicking here and like us on Facebook today to receive regular updates.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

For more resources, information and articles on COVID-19, please visit the dedicated COVID-19 page on our website by clicking here and like us on Facebook today to receive regular updates.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

New legislation to implement the Government’s economic response to coronavirus will provide additional support to SMSFs and their members.

Reducing the minimum drawdown rates

Significant losses in financial markets as a result of the COVID-19 crisis are negatively affecting the account balance of some retirees’ superannuation pension or annuity.

To assist retirees, the Government has reduced the minimum annual payment required for account-based pensions and annuities, allocated pensions and annuities and market-linked pensions and annuities. The minimum annual payment you need to make to your members for the 2019-20 and 2020-21 financial years has been reduced by 50 per cent. You can find details at Minimum annual payments for super income streams.

If you have paid the minimum drawdown amount, payments can be stopped for the remainder of the year. If you have paid more than the minimum drawdown amount, your member can re-contribute these amounts if they are eligible to make superannuation contributions, subject to other rules or limits such as contributions caps.

Adding to super if you’re not working

If you’re under 65 years of age, you can make personal after-tax contributions to your super fund if you’re not working.

If you’re 65 years of age or over and aren’t yet 75 years of age, you can only make personal after-tax super contributions if you meet the work test or work test exemption criteria (which apply from 1 July 2019).

Early release of superannuation

If a member of your SMSF is dealing with adverse economic effects of coronavirus, they may be able to access their super on compassionate grounds in certain circumstances.

From mid-April, eligible members can apply for a release of up to $10,000 of their super before 1 July 2020. They will also be able to access a further $10,000 from 1 July 2020 until 24 September 2020.

To apply for early release, your member must satisfy any one or more of the following requirements:

- They are unemployed.

- They are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance.

- On or after 1 January 2020, either

- they were made redundant

- their working hours were reduced by 20% or more

- if they are a sole trader, their business was suspended or there was a reduction in their turnover of 20% or more.

If your member is eligible, they can apply through myGov from mid April. The ATO will then issue them with a determination advising of their eligibility to release an amount. When you receive the determination from the member, you will be authorised to make the payment.

Trustee responsibilities for early release of super

As an SMSF trustee, you are responsible for you and your members’ retirement savings. Please make sure you are eligible for early release of super before you release any funds from your SMSF.

Temporarily reducing rent

Does your SMSF own real property and is renting to a related party?

Some landlords are giving their tenants a rent reduction or waiver because of the financial effects of COVID-19 and the ATO understand that you may wish to do so as well. The ATOs compliance approach for the 2019–20 and 2020–21 financial years is that they will not take action if an SMSF gives a tenant – who is also a related party – a temporary rent reduction or waiver during this period.

If there are temporary changes to the terms of the lease agreement in response to COVID-19, it is important that the parties to the agreement document the changes and the reasons for the change. This could be by way of a minute or a renewed lease agreement or other documentation.

In-house asset restrictions

If, at the end of a financial year, the level of in-house assets of an SMSF exceeds 5% of a fund’s total assets, the trustees must prepare a written plan to reduce the market ratio of in-house assets to 5% or below. This plan must be prepared before the end of the next following year of income. If an SMSF exceeds the 5% in-house asset threshold as at 30 June 2020, a plan must be prepared and implemented on or before 30 June 2021. However, the ATO will not undertake compliance activity if the rectification plan was unable to be executed because the market has not recovered or it was unnecessary to implement the plan as the market had recovered.

Investment strategies

Trustees must prepare and implement an investment strategy for their SMSF, which they must then give effect to and review regularly. The strategy should be reviewed at least annually, and you should document that you’ve undertaken this review and any decisions arising from the review. Certain significant events, such as a market correction, should also prompt a review of your strategy and may require updating your investment strategy.

If the assets of an SMSF or the level of investment in those assets fall outside of the scope of your investment strategy, you should take action to address that situation, which could involve adjustments to investments or updating your investment strategy. The ATO don’t consider that short term variations to your articulated investment approach, including to specified asset allocations whilst you adjust your investments, constitute a variation from your investment strategy.

All investment decisions must be made in accordance with the investment strategy of the fund. If in doubt, trustees should seek investment advice.

For more resources, information and articles on COVID-19, please visit the dedicated COVID-19 page on our website by clicking here and like us on Facebook today to receive regular updates.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

The problem with this is that only 16% of landlords pay land tax being those landlords with land holdings exceeding $692k as at 31 December 2019.

It’s important to keep in mind this is LAND ONLY value as per the NSW Office of State Revenue AND NOT the market value of the property.

ALSO …

Landlords that have already filed to evict their tenants will have to wait 60 days for their applications to be processed.

When the 60-day moratorium has come to an end, landlords will be able to recover their properties if they are in financial hardship, while tenants will not get a black mark against their names

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

The measures will apply to commercial leases where the tenant is in financial distress due to COVID-19, including but not limited to shops, cafes, gyms, hairdressers, restaurants, offices, warehouses and industrial sites.

Commercial landlords will be offered the land tax concession if they pass the savings on to tenants through a rent reduction.

Eligible landlords will be able to apply for a land tax concession of up to 25 per cent of their 2020 (calendar year) land tax liability on relevant properties. A further land tax deferral for any outstanding amounts for a three-month period will also be offered to landlords who claim the land tax concession.

The Government will give effect to the Code of Conduct, which will operate for a temporary period during the pandemic, and include the following key measures:

- Landlords must negotiate rent relief agreements with tenants in financial distress due to COVID-19 by applying the leasing principles in the Code;

- A ban on the termination of a lease for non-payment of rent;

- A freeze in rent increases.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

The package is targeted at keeping people in rentals over the next six months.

The Government has ordered a six-month moratorium on new forced evictions if the tenant is in rental arrears because they are suffering financial hardship due to coronavirus.

It applies to tenants who have lost 25 per cent or more of their income.

Under the scheme, a landlord or managing agent must enter into negotiations with a tenant who is struggling to make rental payments.

Tenants will be protected from eviction until the tribunal is satisfied that negotiations have been finalised.

But they will have to repay the rent eventually, as anything unpaid will accrue as arrears during this period.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

“For small businesses that are mothballed, electricity and gas network charges will not be applied from the start of April to the end of June 2020, if their consumption is less than a quarter what it was in 2019.

“Networks know it is in everyone’s interest to support small businesses through what is an extremely challenging period.”

The package also includes measures to support households by helping energy retailers provide further assistance to those who fall into hardship as a result of COVID-19.

“Networks will be deferring or rebating electricity and gas network charges for impacted customers,” Mr Dillon said.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

The application form will be available on the Service NSW website by 17 April.

To be eligible, businesses will need to:

- have between 1-19 employees and a turnover of more than $75,000

- a payroll below the NSW Government 2019-20 payroll tax threshold of $900,000

- have an Australian Business Number as at 1 March 2020, be based in NSW and employ staff as at 1 March 2020

- be highly impacted SMEs by the Public Health (COVID-19 Restrictions on Gathering and Movement) Order 2020 issued on 30 March 2020

- use the funding for unavoidable business costs such as utilities, overheads, legal costs and financial advice

- provide appropriate documentation upon application.

Highly impacted industries

Eligible industries are those that have been subject to closure or are highly impacted by NSW Government health directions in relation to COVID-19 and include:

- Retail trade

- Accommodation and food service

- Rental, hiring and real estate services

- Administrative and support services

- Arts and recreation services.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

The new laws override any modern award, enterprise agreement or employment contract.

Under the new laws an employer can:

- Stand down an employee without pay (completely or partially) for any period that they cannot be usefully employed.

- Change employment arrangements (such as what they do, where they work and when they work) for a specific employee.

-

WHAT IS THE JOBKEEPER WAGE SUBSIDY?

The JobKeeper wage subsidy is a $1,500 fortnightly payment to subsidise wages of eligible employees. Employers must have a revenue reduction of 30% to access the subsidy (or 50% for businesses with a turnover of $1bn or more). Employers are able to register with the Australian Taxation Office.

Here’s more on how to apply.

Employers can register their interest at the ATO Job Keeper webpage.

-

WHAT ARE THE NEW STAND DOWN PROVISIONS?

The new stand down provisions allow an employer to give a direction (called a JobKeeper enabling stand down direction) to an employee to:

- Not work on a day or days on which the employee would usually work.

- Work for a lesser period than the period which the employee would ordinarily work on a particular day or days.

- Work a reduced number of hours (compared with the employee’s ordinary hours of work),

and not be paid for the period that work is not performed.

An employer can do this provided that:

- When the direction is given the employer qualified for the JobKeeper scheme.

- For the period of the stand down the employee cannot be usefully employed for the employee’s normal days or hours because of changes to business attributable to the COVID-19 pandemic or Government initiatives to slow the transmission of COVID-19.

- The implementation of the stand down direction is safe and specifically safe having regard to the nature and spread of COVID-19.

- The employer becomes entitled to one or more JobKeeper payments for the employee for the period that the JobKeeper direction applies.

- The “wage condition” is satisfied (explained below).

- The minimum payment guarantee is met (explained below).

- The hourly rate of pay guarantee is met (explained below).

How do I know an employee cannot be usefully employed?

This situation arises when an employee has no (or a reduced level of) useful work available to perform because of the COVID-19 pandemic or because of the Public Health Orders and Directions (however described in each State and Territory) imposing restrictions on individuals and businesses.

Useful work does not have to be the work that the employee ordinarily performs but needs to be genuine productive work that provides a “net benefit” to the employer.

You should be able to demonstrate that the impacts of the virus or the Government’s measures to deal with it have caused the fact that there is none, or less useful, work available.

What is the wage condition?

Essentially it means the employer:

- Qualifies for the JobKeeper scheme.

- Is entitled to JobKeeper payments for an employee and otherwise complies with the Coronavirus Economic Response Package (Payments and Benefits) Act 2020. Compliance will involve “Rules” yet to be announced by the Government through the ATO.

What is the Minimum Payment Guarantee?

If a JobKeeper payment is payable to an employer for an employee for a fortnight, the employer must ensure that the total amount payable to the employee in respect of the fortnight is not less than the greater of the following:

- The amount of JobKeeper payment payable to the employer for the employee for the fortnight.

- The amounts payable to the employee in relation to the performance of work during the fortnight.

What does “amounts payable” include?

This includes the following, if they become payable in respect of the fortnight:

- Incentive-based payments and bonuses.

- Monetary allowances.

- Overtime or penalty rates.

- Leave payments.

What is the “hourly rate of pay guarantee”?

If a stand down direction is given by an employer to an employee, the employer must ensure that the hourly base rate of pay is not less than the rate that usually applies to the employee (as if the direction had not been given to the employee).

If an employer has directed the employee to perform different duties to normal (explained below) the employer must ensure that the employee’s hourly base rate of pay is not less than the greater of the following:

- The hourly base rate of pay that would have been applicable to the employee if the direction had not been given to the employee.

- The hourly base rate of pay that is applicable to the duties the employee is performing.

What is the “hourly base rate”?

The hourly base rate is the rate of pay payable for an employee’s ordinary hours of work, without any additional allowances, loadings or penalties added.

If the employee is not paid hourly, the hourly base rate of pay will generally be determined by:

- The provisions of any applicable industrial instrument (e.g. a modern award or enterprise agreement).

- Where no industrial instrument applies, dividing the payment made in each pay cycle by the number of ordinary hours in the period (again, minus any additional allowances, loadings or penalties added).

Further advice should be sought regarding this issue where unique payment arrangements exists with varying numbers of ordinary hours in each pay cycle.

When does a stand down direction not apply?

A stand down direction does not apply to the employee during a period when the employee is:

- Taking paid or unpaid leave that is authorised by the employer.

- Otherwise authorised to be absent from the employee’s employment.

-

WHAT ARE THE WORKFORCE FLEXIBILITIES AN EMPLOYER CAN USE BY DIRECTION?

There are two scenarios to understand:

1) Direct an employee to perform different duties to normal.

An employer can give this JobKeeper direction provided that:

- The duties are within the employee’s skill and competence.

- When the JobKeeper direction is given the employer qualified for the JobKeeper scheme.

- The duties to be performed are generally safe and specifically safe having regard to the nature and spread of COVID-19.

- The employee holds any necessary licence or qualification required to perform the duties.

- The duties are reasonably within the scope of the employer’s business operation.

- The employer becomes entitled to one or more JobKeeper payments for the employee for the period that the JobKeeper direction applies.

2) Direct an employee to perform duties at a place different to their normal work place including the employee’s home.

An employer can give this JobKeeper direction provided that:

- The place is suitable for the employee’s duties.

- When the JobKeeper direction is given the employer qualified for the JobKeeper scheme.

- The performance of the duties at that place are generally safe and specifically safe having regard to the nature and spread of COVID-19.

- The performance of the duties at that place is reasonably within the scope of the employer’s business operation.

- The employer becomes entitled to one or more JobKeeper payments for the employee for the period that the JobKeeper direction applies.

What test applies to giving these directions?

The test requires that any of these directions can only apply if the employer has information before them that leads them to reasonably believe that the JobKeeper direction is necessary to maintain the employment of the employee.

To explain this further, there are three elements to this:

1) Information before the employer

The belief needs to be based on “information”. This cannot be a simple whim or a view based on nothing. There needs to be some form of factual material before the employer.

2) Reasonable belief

Reasonable belief is just that. The belief must be available on the information the employer has before them and needs to be reasonably available.

3) Necessary to maintain the employment of the employee

The best way to describe this is to apply what lawyers call a “but for” test.

But for you doing this (directing different duties or a different work location) the employee would be made redundant.

This is a quite high test and requires more than the JobKeeper direction being desirable or preferred but “necessary” to avoid this.

-

DO ANY OTHER TESTS APPLY TO GIVING A JOBKEEPER DIRECTION?

Yes, there is a general overarching requirement that applies to:

- Directing an employee to stand down without pay (fully or partially).

- Directing an employee to perform different duties.

- Directing an employee to work on different days.

These directions do not apply to the employee if the JobKeeper direction is unreasonable in all of the circumstances.

What does “unreasonable in all of the circumstances” mean?

This is a very broad test and requires a consideration of anything relevant including the personal circumstances of the employee concerned.

Remember, there are varying degrees to which an act might be reasonable. There is no obligation on an employer to act in the most reasonable way available. What is important, however, is that a Court or Tribunal considering any direction does not consider the act to be unreasonable.

-

WHAT ARE THE WORKFORCE FLEXIBILITIES AN EMPLOYER CAN USE BY REQUEST AND AGREEMENT?

There are two:

1) Request the employee to perform duties on different days and at different times compared to the employee’s normal ordinary hours of work.

An employer can request an employee to perform duties on different days and at different times compared to the employee’s normal ordinary hours of work provided that:

- The employer requests the employee to do so.

- The employee must consider and not unreasonably refuse the request.

- The employer qualified for the JobKeeper scheme.

- The performance of the duties on those days is generally safe and specifically safe having regard to the nature and spread of COVID-19.

- The performance of the duties on those days is reasonably within the scope of the employer’s business operation.

- The employer becomes entitled to one or more JobKeeper payments for the employee for the period that the days or hours are worked.

2) Direct an employee to take paid annual leave.

- An employer can request an employee to take paid annual leave provided that:

- The employer requests the employee to do so.

- The employee must consider and not unreasonably refuse the request.

- The employer qualified for the JobKeeper scheme.

- The employee will maintain a balance of paid annual leave of no fewer than two weeks.

- The employer becomes entitled to one or more JobKeeper payments for the employee for the period of the leave.

Payment for the leave

Payment for the leave is based on the rate of pay that applied before the JobKeeper legislation operated.

Double leave on half pay

The employer and employee can agree to take double the paid annual leave at half pay. By way of example, an employer and employee can agree to four weeks leave being taken, but the employee only has two weeks annual leave deducted and is only paid for two weeks annual leave

- WHAT ARE THE CONSULTATION OBLIGATIONS?

Before you give a JobKeeper direction the employer must:

- Give the employee written notice of the intention to give the JobKeeper direction at least three days before the JobKeeper direction is given or a lesser period if agreed with the employee.

- Consult with the employee (or a representative of the employee) about the direction.

The “notice” might be in a prescribed form. It is not yet clear whether a form will be prescribed by the Government.

-

Conclusion

The amendments are intended to be temporary and will be subject to a review process commencing the end of July 2020.

If you’d like to discuss your business situation please contact us on 02 4228 4877or at info@Journey2.com.au

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

The spread of COVID-19 is changing the way we live, work and communicate. It’s sparked economic uncertainty which is already impacting Australian businesses and people in an unprecedented emotional and financial level. During this time, your accountant and financial planner will need to play an important role as your trusted adviser, to help you secure your financial well-being in a time of uncertainty.

Here at Journey2 Business & Personal Wealth, we want to help you by giving you the tools to navigate these difficult times, so that that you can feel more secure about your financial future. To make this happen we will give you:

Free Subscription to Myprosperity (Basic)

MyProsperity is a web based ‘platform and APP’ that helps motivate, manage and record all aspects of your finances and wealth.

It’s perfect for:

- Monitoring your personal cash flow management & progress towards financial goals.

- Help to balance the budget. It’s a solution to better control your cash flow and expenses.

- A place to store all financial data, records and information, tax returns, insurances, estate planning docs……. everything.

- You get can get real time values of bank accounts, shares and investments, superannuation (most products) and property values and mortgage balances. (Pro version).

- A place to record and measure financial goals and objectives. Keeping you on track financially to pay off mortgage, savings and investing.

Free Wealth check (optional)

Myprosperity provides a really easy platform & process for you to update and store all of your financial information in one place so that you can not only have peace of mind. It provides a simple checklist and financial profile to complete for the Wealth Check

Free Wealth report (optional)

Following the wealth check, you will be able to access a wealth report in your client portal which you can send to your trusted adviser. The wealth report is a really simple way for you to give your adviser their whole-of-wealth assessment, which will guide them to providing the most meaningful and holistic advice given your circumstances. See a sample report here.

Free Will(optional)

Naturally some people will be concerned about their estate plans, in particular, some of your older clients and their parents. In the short term, if your needs are straight forward we have made available a free online basic will that only takes minutes to create. We do recommend that you have a will, enduring power of attorney, and health directive established through your solicitor as soon as possible.

To take advantage of the above free tools please click here or email Veronica for more information.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

To claim a deduction for working from home, all of the following must apply:

- You must have spent the money.

- The expense must be directly related to earning your income.

- You must have a record to prove it.

This means you cannot claim a deduction for items provided by your employer or if you have been reimbursed for the expense.

If you are not reimbursed by your employer, but instead receive an allowance from them to cover your expenses when you work from home, you:

- must include this allowance as income in your tax return.

- can claim a deduction as outlined in this fact sheet.

Expenses you can claim

If you work from home, you will be able to claim a deduction for the additional running expenses you incur. These include:

- electricity expenses associated with heating, cooling and lighting the area from which you are working and running items you are using for work

- cleaning costs for a dedicated work area

- phone and internet expenses

- computer consumables (for example, printer paper and ink) and stationery

- home office equipment, including computers, printers, phones, furniture and furnishings – you can claim either the:

- full cost of items up to $300

- decline in value for items over $300.

We understand that tracking all of these expenses can be challenging at this time. So we will accept a temporary simplified method (or shortcut method) of calculating additional running expenses for the period starting 1 March 2020 until at least 30 June 2020. We may extend this method, depending on when work patterns start to return to normal.

Expenses you can’t claim

If you are working from home only due to COVID-19, you:

- cannot claim occupancy expenses such as mortgage interest, rent and rates

- cannot claim the cost of coffee, tea, milk and other general household items your employer may otherwise have provided you with at work.

Calculating running expenses

There are three ways you can choose to calculate your additional running expenses:

- actual cost method ─ claim the actual work-related portion of all your running expenses, which you need to calculate on a reasonable basis.

- shortcut method ─ claim a rate of 80 cents per work hour for all additional running expenses

- fixed rate method ─ claim all of these:

- a rate of 52 cents per work hour for heating, cooling, lighting, cleaning and the decline in value of office furniture,

- the work-related portion of your actual costs of phone and internet expenses, computer consumables, stationery, and

- the work-related portion of the decline in value of a computer, laptop or similar device.

For more information on how to calculate and claim a deduction under the actual cost method or fixed rate method see Home office expenses.

Shortcut method

You can claim a deduction of 80 cents for each hour you work from home due to COVID-19 as long as you are:

- working from home to fulfil your employment duties and not just carrying out minimal tasks such as occasionally checking emails or taking calls,

- incurring additional deductible running expenses as a result of working from home.

You do not have to have a separate or dedicated area of your home set aside for working, such as a private study.

The shortcut method rate covers all deductible running expenses, including:

- electricity for lighting, cooling or heating and running electronic items used for work (for example your computer), and gas heating expenses

- the decline in value and repair of capital items, such as home office furniture and furnishings

- cleaning expenses

- your phone costs, including the decline in value of the handset

- your internet costs

- computer consumables, such as printer ink

- stationery

- the decline in value of a computer, laptop or similar device.

You do not have to incur all of these expenses, but you must have incurred additional expenses in some of those categories as a result of working from home due to COVID-19.

If you use the shortcut method to claim a deduction for your additional running expenses, you cannot claim a further deduction for any of the expenses listed above.

You must keep a record of the number of hours you have worked from home as a result of COVID-19. Examples are timesheets, diary notes or rosters.

If you use the shortcut method to claim a deduction and you lodge your 2019-20 tax return through myGov or a tax agent, you must include the note ‘COVID-hourly rate’ in your tax return.

Records you must keep

If you use the shortcut method, you only need to keep a record of the hours you worked at home, for example timesheets or diary notes.

If you use the other methods, you must also keep a record of the number of hours you worked from home along with records of your expenses. For more information on what those records are see Home office expenses.

We will update this page as more information becomes available.

Under the scheme, landlords will be instructed to reduce their commercial tenant’s rent in proportion to the tenants lost revenue due to the impact of COVID-19.

A mandatory code will apply to tenancies including retail, office and industrial:

- where the tenant or landlord is eligible for the JobKeeper program

- where businesses have a turnover of $50 million or less.

The code will be rolled out and implemented in each state and territory and also stipulates:

- landlords must not terminate the lease or draw into a tenant’s security bond

- likewise, tenants must not terminate the lease.

The scheme will be implemented through a combination of rent waivers and deferrals. The waivers will have to account for 50% of the reduction in business and deferrals (payments that will need to be paid but can be put off) must be spread over the remaining lease term, but for no less than 24 months.

The purpose of the code is to impose a set of good faith leasing principles to commercial tenancies (including retail, office and industrial) between owners, operators, landlords and their tenants.

Prime Minister Scott Morrison said of the scheme: “This preserves the lease, it preserves the relationship, it keeps the tenant in the property.”

The National Cabinet also expects Australian and foreign banks, along with other financial institutions operating in Australia to support landlords and tenants with appropriate flexibility as the code is implemented.

- Not all banks qualify

- Funds are limited

- These loans end 30/09/2020 and you could miss out

- Applying for this loan is as challenging as it has been for any other loan

- Our 6 Step process will take the stress out of the borrowing process and get you the money you need when you need it

HOW THE LOAN SCHEME WORKS

The Coronavirus SME Guarantee Scheme will provide small and medium sized business with timely access to working capital to help them get through the impact of the Coronavirus.

The Government will provide eligible lenders with a guarantee for loans with the following terms:

- SMEs, including sole traders, with a turnover of up to $50 million.

- Maximum total size of loans of $250,000 per borrower.

- Loans will be up to three years, with an initial six month repayment holiday.

- Unsecured finance, meaning that borrowers will not have to provide an asset as security for the loan.

The decision on whether to extend credit, and management of the loan, will remain with the lender.

However, the Government expects that lenders will look through the cycle to sensibly take into account the uncertainty of the current economic conditions when determining whether credit should be extended.

As part of the loan products available, the Government will encourage lenders to provide facilities to SMEs that only have to be drawn if needed by the SME.

This will mean that the SME would only incur interest on the amount they draw down.

If they do not draw down any funds from the facility, no interest will be charged, but they will retain the flexibility to draw down funds should the need arise.

WHY YOU NEED TO APPLY NOW

The Government Guaranteed Unsecured Loan Scheme is limited to just $40 billion

Every Bank and other financial institutions will need to apply to the government:

- To qualify to be included as an eligible lender, and

- for a portion of the $40b billion to be allocated to them.

There is no guarantee that the government will allocate the full amount requested by each eligible lender .

So the big questions FOR YOU are:

- Will you current financial institution qualify as an eligible lender?

- If they do, how much will your financial institution get?

- How quickly will your financial institution use up their allocation ?

- If and When should you apply for your loan?

Ideally your personal circumstances should be reviewed and your cash flow needs reviewed and forecasted for the next 12 to 36 months.

My concern with this is that this process will take time and any forecast is just that, a forecast and your circumstances will change as the surrounding circumstances change so your decision to apply for the loan may be left for several months.

Overlaying this is the fact that, based on what the government has said to date, the loans will only be available to the end of September 2020.

BECAUSE of the above it is our recommendation that you should start applying for the loan now.

WHY, so that you can…

- Find out if your financial institution qualifies as an eligible lender, and if they don’t

- Look for an alternate financial institution that qualifies as an eligible lender AND are prepared to lend to you

- Confirm whether they still have available funds from their allocation

- Ascertain what their lending criteria is and what you have to provide them with

- Have sufficient time to get them everything they want so they can process your application in time to get you the money when you need it.

TAKE THE STRESS OUT OF BORROWING WITH OUR 6 STEP PROCESS

The team at Journey2 Business and Personal Wealth have, for the past 35 years, been assisting clients to successfully apply for finance, from $250 million for the purchase a high rise in the Sydney CBD to $20,000 asset finance for equipment and everything in between. We understand what the financial institution will want and how to deliver it to them in the most efficient and cost effective way possible.

You have enough going on in your business right now dealing with the economic and physical impact of COVID-19.

Let us do all the heavy lifting in securing your share of the Government Guaranteed Unsecured Loan Scheme with our 6 STEP Process:

- Zoom meeting to discuss with you what you think your immediate, medium and long term cash flow issues and concerns will be.

- We will then prepare high level cash flow forecast with various scenarios to understand what will happen in the short term, will probably happen in the medium term, and could happen in the long term.

- Based on the above work out how much money you will need and when you will need it.

- Enquire from your, and one or two other, financial institution(s) for the required loan as a line of credit

- Recommend what we consider to be the best option to you.

- Prepare, lodge and follow through the loan application to completion.

To find out more or to book your STEP 1 ZOOM MEETING, call Veronica on 02 4228 4877 to book a time, or simply CLICK THIS to book a time directly on line.

The relief package is designed to:

- provide free child care to around one million families; and

- ensure that as many of the child care sector’s 13,000 child care and early learning services as possible keep their doors open for families that need to work and to support vulnerable children during the Coronavirus pandemic.

Based on the Prime Minister’s Media Release of 2 April 2020, the relief package will involve additional funding for the child care sector, broadly as follows:

(a) The Government will pay 50% of the child care sector’s fee revenue (presumably, this would be paid to each eligible child care and early learning centre) up to the existing hourly rate cap.

(b) The additional funding will apply from 6 April 2020, based on the number of children who were in care during the fortnight leading into 2 March 2020, whether or not they were attending care.

(c) The additional funding will only be available as long as centres remain open and do not charge families for care.

(d) The payments made under the relief package will commence to be made at the end of next week and will be made in lieu of the Child Care and Additional Child Care Subsidy payments.

(e) Payments of higher amounts will be available in exceptional circumstances, such as where greater funding is required to meet the needs of emergency workers or vulnerable children.

(f) Until the payments are made, the Government will allow centres to waive gap fees for families who keep their children home, and families will be able to use the 20 extra absence days the Government has funded for Coronavirus-related reasons without giving up their place in a centre.

(g) The new funding arrangements will be reviewed after one month, with an extension to be considered after three months.

The Prime Minister’s Media Release also advises that families who have terminated any child’s enrolment since 17 February 2020 should get in contact with the relevant centre to re-start the child’s enrolment.

Furthermore, re-starting a child’s enrolment:

- will not require families to send their children to child care;

- will not require families to pay a gap fee; and

- will hold the child’s place at the centre for the point in time when things start to normalise and families are ready to take their children back to their centre.

In a separate media statement, the Minister for Education, Dan Tehan, also indicated that means testing arrangements to access the child care subsidy for those who are working during the six-month Coronavirus pandemic will no longer be in place.

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

- provide up to two weeks unpaid leave for an employee required to self-isolate or is otherwise prevented from working because of measures taken by the government or medical authorities in response to the COVID-19 pandemic, and

- allow an employer and employee to agree to take double annual leave on half pay.

The changes could be introduced as early as next Wednesday (8 April 2020) and would operate until 30 June 2020.

The bench issued a statement outlining its provisional views of variations under s 57(3) of the Fair Work Act, saying it was “made in the context of the unique circumstances pertaining to the COVID-19 pandemic”.

“The proposed entitlement will also support the important public policy objective of encouraging those who should self-isolate to do so and thereby limit the spread of COVID-19 in workplaces, allowing businesses to continue to operate.”

It does not prevent other variation applications being made to modern awards to combat COVID-19.

Full benches of the Commission have recently made variations on an expedited basis to the:

- Hospitality Industry (General) Award 2010

- Clerks – Private Sector Award 2010

- Restaurant Industry Award 2010.

Those variation applications had the support of the major industrial parties. They were also supported by the Australian Council of Trade Unions and the Minister for Industrial Relations.

The above information was sourced from an email By Marise Donnolley Editor – Business Australia. You can read the full Fair Work Commission statement here.

The JobKeeper scheme has been well received and welcomed by all sectors of the economy. In fact, many employers have already contacted employees affected (including those who have been stood down without pay) to inform them that the employer will register for the JobKeeper scheme and make payments to employees from the first week of May 2020.

In some cases, employers have also contacted employees who had recently lost their job and have been receiving the JobSeeker Payment whilst not working. In these situations, where a former employee is re-hired, the JobKeeper Payment could offer the employee a greater fortnightly payment when compared to the JobSeeker Payment, for example, as follows:

- Under the JobKeeper Payment scheme – an eligible employee will receive (through their employer) minimum fortnightly salary income of $1,500.

- Under the JobSeeker Payment scheme – an eligible employee (assuming they are single with no children) would be expected to receive a fortnightly payment of up to $565.70 plus the $550 Coronavirus supplement (resulting in a total fortnightly payment of up to around $1,115). However, JobSeeker recipients may also be eligible for other Government entitlements.

Important considerations for employers under JobKeeper

However, before employers apply for the JobKeeper Payment and start making salary payments to employees under this scheme (including employees who have been re-hired by an employer), it is important for an employer to consider the following potential consequences of JobKeeper:

- Whether JobKeeper payments made to an employer will be assessable to the employer – In the absence of any specific exemption, such payments could be assessable to an employer under S.6-5 or S.15-10 of the ITAA 1997.

- Whether PAYG withholding will apply to JobKeeper payments – In the absence of any specific withholding exemption/variation, JobKeeper subsidies paid to an employer which are then used to ‘top-up’ an employee’s existing salary may be subject to the normal PAYG withholding rules.

- Whether Superannuation Guarantee (‘SG’) contributions are required in respect of JobKeeker payments – The Government has indicated that an employer will have the option of choosing whether or not to make SG contributions in respect of any additional salary income paid to an employee (to the extent it relates to the JobKeeper Payment).

- Whether potential Payroll tax obligations may arise – This will ultimately depend on the relevant legislation of each State and Territory. In light of the Coronavirus pandemic generally, most States and Territories have indicated that they will waive or defer liabilities for Payroll tax for the 2020 (and possibly for the 2021) financial years. However, employers who re-hire staff may end up breaching Payroll tax relief thresholds.

- Whether a potential liability for WorkCover premiums will arise – This will also ultimately depend on the relevant legislation of each State and Territory.

- Whether leave entitlements (e.g., annual leave, sick leave and long service leave) can accrue in respect of employees who receive the JobKeeper Payment from their employer (potentially resulting in additional liabilities for employers).

Please note: The proposed JobKeeper Payment is not yet law, and the National Tax Agents Association is not yet aware of any clear guidance provided by Federal or State Governments (where appropriate) in relation to many of the issues raised above.

The ATO will discuss deferrals of payments for 6 months to 12/09/2020 for;

- income tax,

- business activity statement (GST, PAYGWT, PAYGT)

- FBT and

- excise payments.

Affected businesses will be able to apply to the ATO to;

- stop interest accruing on current tax debts

- arrange low-interest payment arrangements for tax debts being incurred during COVID-19 period

- apply for remission of past interest and penalties incurred after 23 January 2020.

- arrange low-interest payment arrangements for tax debts being incurred before COVID-19 period

The ATO is encouraging affected businesses to;

- change their GST reporting cycle from quarterly to monthly so that business can access GST refunds earlier. That is if you get a refund.

- that pay quarterly pay as you go (PAYG) instalments, vary their PAYG instalments to a lower rate or even zero.

- claimed back from the ATO, PAYG instalments made for the June 19, September 19 December 19 and March 20 (if already [paid) prior quarters.

Super Guarantee Obligations

By law, the ATO can’t vary the contribution due date or waive the super guarantee charge.

So if you are an employer, you need to continue to meet your super guarantee obligations for your employees.

What to do now

Remember that the above assistance will be considered by the ATO if your business has been affected by the economic impact of COVID-19.

At this point in time the ATO has not indicated what their criteria is so I assume it will be on a case by case basis but will be similar to the other stimulus measure eligibility criteria, i.e. 30% drop.

On the basis that you believe you do qualify, moving forward you have 2 options to take advantage of the above:

- Contact the ATO yourself and negotiate the above or,

- Engage our services to do it for you

If you choose to engage the services of our firm, then please contact our Client Service Co-ordinator, Veronica Maddox, on 02 4228 4877 to book a time with Jacqueline Berriman as Jacqueline will be responsible for all ATO negotiations as she has been in the past, because she is damn good at it!!.

Stay Safe – Stay Home

P: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

Summary of COVID-19 Stimulus Measures as at 30 March 2020

As to the new Jobkeeper payment, we are still collecting more information and its practical application and operation for all circumstances. As soon as we get the information we will pass it on to you. From what I have seen so far it’s not quite as easy as it sounds in the news broadcasts, but then again who expected it to be!

Stay safe and don’t forget that today is your last chance for the MARCH end of month draw. The wine will be delivered to the winner via Dan Murphy’s delivery system. To date, I believe there are only about 30 people in the draw for so … Complete the FirmChecker Feedback AND/OR “LIKE” our Facebook page today for your chance to WIN a bottle of wine. You choose, Red, White, Rose, or Prosecco …. Winners will be chosen at the end of each month until 30 June 2020!!!

T: (02) 4228 4877

E: info@journey2.com.au

W: http://www.journey2.com.au

A: Level 1, 63 Market Street, Wollongong NSW 2500

P: PO Box 816, Wollongong NSW 2500

The government has today announced an additional $66Billion bringing the total economic assistance package now worth $189 billion or the equivalent of 9.7 per cent of Australia’s Gross Domestic Product. $31.9

On the economic front, small businesses will receive cash payments up to $100,000 and some welfare recipients will receive another $750.

Additional measures for individuals include:

- Temporarily doubling the Jobseeker Payment, previously called Newstart via introduction of Corona Virus Supplement of $550pft on top of existing Jobseeker allowance

- Waive asset test and waiting period for the above AND will be available to sole traders who meet the income test who’s income has been affected by COVID-19

- Certain Australian’s on other income support will receive an addition $750 from July 13th in addition to the previous $750 announced in the first stimulus package.

- From April Australians entitled to Corona Virus Supplement,(unemployed) as well as casuals and sole traders (where hours worked or income fall by 20% or more) will be given access to their super capped at $10,000 from their superannuation in 2019-20 and 2020-21. These withdrawals will be TAX FREE.

- Reducing deeming rates for pensioners by a further 0.25 per cent

- Min Draw down from super reduced from 4% pa to 2% for FY 2020 and 2021

Additional measures for businesses include:

- All employing business to receive AT LEAST $20k min up to $100k where biz has turnover under $50mill . Automatically paid by the ATO after 28/04. To include not for profits that qualify.

- Aust Gov guaranteeing unsecured small business loans up to $250,000 up to 3 years for biz turnover under $50mill. To start early April. No repayments for up to 6 months.

- Insolvency & Liquidation regulatory shield

- Increase threshold from $2k to $20k where a creditor can take legal action to wind up a business

- Companies and individuals 6 months instead of 21 days to respond

- Relief for directors from personal liability where the company is trading insolvent whilst insolvent over the next 6 months.

- Temporary 6 month power to Treasurer to give companies amnesty if they are unable to comply with Corporations Act because of the Corona Virus

There are 3 areas of URGENT importance that you need to be aware of:

- Government Stimulus Package – what you may be entitled to

- Business Continuity Planning – daily strategies to keep your business on top and afloat

- Operational & Asset Protection – Get your Will and Enduring Power Of Attorney updated or set up NOW in case you are quarantined or worse still hospitalised. How will your business continue if you can’t be there

- GOVERNMENT STIMULUS PACKAGE – OUR TAX PLANNING MEETING WITH YOU THIS YEAR WILL BE VITAL!

The Australian Government has just released a $17.6 billion economic stimulus package. The package has been marketed as a measure to protect the economy by maintaining confidence, supporting investment and keeping people in their jobs.

The key tax and stimulus measures include:

Business Investment

- From Thursday 12 March 2020, the instant asset write-off threshold has been increased from $30,000 (for businesses with an aggregated turnover of less than $50 million) to $150,000 (for businesses with an aggregated turnover of less than $500 million) until 30 June 2020.

- A time-limited 15-month investment incentive (through to 30 June 2021) which will operate to accelerate certain depreciation deductions. This measure will also be available to businesses with a turnover of less than $500 million, which will be able to immediately deduct 50% of the cost of an eligible asset on installation, with existing depreciation rules applying to the balance of the asset’s cost. As announced, this measure is proposed to only apply to new depreciating assets first used, or installed ready for use, by 30 June 2021.

Cashflow Assistance

- Tax-free payments of up to $25,000 for eligible small and medium businesses (i.e., with a turnover of less than $50 million that employ staff) based on their PAYG withholding obligations. This is not a cash payment, but it is a credit equal to 50% of the PAYG amounts withheld from salary and wages paid to employees.

Businesses that lodge activity statements on a quarterly basis will be eligible to receive the credit for the quarters ending March 2020 and June 2020. Business that lodge on a monthly basis will be eligible for the credit for the March 2020, April 2020, May 2020 and June 2020 lodgements.

If a business pays salary and wages to employees but is not required to withhold any tax, then a minimum payment of $2,000 will still be made. The minimum $2,000 payment will be applied to the first activity statement lodgement.

- Wage subsidies to support the retention of apprentices and trainees – Employers with less than 20 full-time employees may be entitled to apply for Government funded wage subsidies amounting to 50% of an apprentice’s or trainee’s wage for up to nine months from 1 January 2020 to 30 September 2020. The maximum subsidy for each apprentice/trainee is $21,000.

Individual Assistance

- Tax-free payments of $750 to social security, veteran and other income support recipients and eligible concession card holders. It is estimated that around half of those who will benefit will be pensioners. These payments will commence to be automatically made from 31 March 2020.

When we have our 2020 Tax Planning meeting with you over the next few weeks, we will assist you with opportunities to restructure how you pay yourself to that you can receive the maximum cashflow assistance amounts from the Government.

Contact us TODAY on 02 4228 4877 if you would like to meet with us earlier to ensure you receive your maximum cashflow assistance from the Government.

- BUSINESS CONTINUITY PLANNING

As a business owner, now is the time to plan for employees being away from your workplace, shortages of supply, reduction in sales, and the possibility of your workplace being closed for a short period of time if every is being forced to self-quarantine.

Over the next few weeks, we would like to meet with you or have a Zoom Meeting to discuss the following:

- Employees working from home, and workplace obligations

- How do pay your bills in the short term if your sales start to dry up

- How to communicate in a reassuring way with your clients and customers

- How to keep things moving with your business

We’re not suggesting in any way that we have all the answers, but it is important for us to work with you and help you and plan for what will happen in the weeks and months ahead.

Complete and return the EMAIL REPLY TEMPLATE or contact us TODAY at info@journey.com.au to book in a 30 minute Zoom online meeting so we can discuss your business situation and make plans to assist you.

- GET YOUR WILL AND ENDURING POWER OF ATTORNEY (EPOA) UPDATED / SET UP NOW

If you have to self-quarantine or are admitted to hospital, if you don’t have an EPOA then no-one else can make OR execute important business or financial decisions on your behalf.

As a business owner, it is 100% essential that you have an up to date EPOA and Will, and that your family know where these are stored.

From our professional associations we have teamed up with Abbott Morley Lawyers to offer you a fast, easy and professional way to get these documents prepared quickly. Alternatively we can use the legal firm of your choice.

Contact our office info@journey2.com.au and we will email you our “Will and EPOA Data Capture Form” to get started.

NEXT STEPS

These are times when we need to stay calm and rely on reliable news sources and information from State and Australian Government websites. What you see on social media may be panicky and unreliable information – stay away from this!

Our team here at Journey2 Business and Personal Wealth are here to help you. Please contact us on 02 4228 4877 or info@journey2.com.au if you need any assistance!

Snapshots & Infographics

Do you need assistance?

If you would like any assistance implementing the tools and information provided below, please contact us today.

We are here to help!