2023 Budget

The 2023 Australian Budget has been released, outlining the government’s plans for the country’s economic future. This year’s budget promises investments in infrastructure, healthcare, education, job creation, climate change and support for disadvantaged communities. However, there will likely be winners and losers, and debates about the effectiveness and fairness of the policies proposed. We’ll explore the key highlights of the budget.

SME’s

SMALL BUSINESS ENERGY INCENTIVE

An incentive program called the Small Business Energy Incentive will be launched to aid small and medium-sized businesses in improving their energy efficiency and transitioning to electric assets. The goal is to assist eligible businesses in reducing their energy bills.

Businesses with an aggregated annual turnover of less than $50 million will be able to receive an additional 20% deduction on the cost of eligible depreciating assets that promote electrification and energy efficiency. The maximum expenditure allowed for this incentive is $100,000, with a maximum bonus deduction of $20,000.

Eligible expenses can include the purchase of new assets as well as upgrades to existing ones. Examples of eligible assets include heating and cooling systems that use electricity, batteries, and high-efficiency electrical goods. To qualify, these assets must be first used or installed between July 1, 2023, and June 30, 2024.

The program is expected to provide $310 million in tax relief and support up to 3.8 million businesses. Some exclusions apply, such as electric vehicles, renewable electricity generation assets, capital works, and assets that are not connected to the electricity grid and use fossil fuels. Eligibility criteria will be finalized after consulting with stakeholders. In addition to this program, small and medium-sized enterprises can also receive energy efficiency grants worth $62.6 million announced in the October 2022 Budget.

Amendment to the electric Car Fringe Benefits Tax exemption

The Federal Budget announced last year a fringe benefits tax exemption for eligible zero or low emissions vehicles, including electric cars, hydrogen fuel cell electric cars, and plug-in hybrid electric cars. This exemption became effective from July 1, 2022.

The Government has now declared that the fringe benefits tax exemption for plug-in hybrid electric cars will come to an end on April 1, 2025. Any arrangements that involve plug-in hybrid electric cars, made between July 1, 2022, and March 31, 2025, will still be eligible for the exemption.

Reduction of tax instalments for small businesses

The Government is planning to help small businesses and individuals with their cash flow by lowering the GDP adjustment factor used in calculating PAYG and GST instalments. For the 2023-24 income year, the factor will be reduced to 6%, instead of the usual 12% that would be used. This will apply to businesses and individuals with an annual turnover of up to $50 million for PAYG instalments and $10 million for GST instalments. The change will apply to instalments due after the legislation receives Royal Assent and will relate to the 2023-24 income year.

ATO Debt Recovery

The Government will provide funding to the Australian Taxation Office (ATO) over four years from 1 July 2023 to improve its engagement with taxpayers and ensure they pay their tax and superannuation liabilities on time. The ATO will have resources to engage with certain taxpayers, specifically public and multinational groups with an aggregated turnover of more than $10 million or privately owned groups or individuals with over $5 million of net wealth, who have large tax debts exceeding $100,000 and aged debts of more than two years.

For small businesses with an aggregated turnover of less than $10 million, there will be a penalty amnesty for lodgment that will remit failure-to-lodge penalties on outstanding tax statements lodged between 1 June 2023 and 31 December 2023. These statements were originally due for lodgment from 1 December 2019 to 29 February 2022.

Increased amendment period for small businesses

Starting July 1st, 2025, small businesses will have an extended period of four years to make changes to their income tax returns, instead of the current two-year period. The aim of this measure is to reduce the workload and burden on small businesses when revising their income tax returns.

Temporary increase to instant asset write-off

Starting from 1 July 2023 and until 30 June 2024, the instant asset write-off threshold will be temporarily increased to $20,000. This means that businesses with an annual turnover of less than $10 million will be able to immediately deduct the cost of eligible assets worth less than $20,000 when they are installed or ready for use. However, the $20,000 threshold is applied on an asset-by-asset basis. This is a change from the current threshold for businesses with a turnover of less than $5 billion, which allows for full deduction of eligible assets first held or installed ready for use between 6 October 2020 and 30 June 2023.

For assets that cost more than $20,000, businesses can still apply the small business simplified depreciation pool which means depreciation is at 15% in the first income year and 30% each income year after. In addition, businesses that previously opted out of the simplified depreciation pool will be able to re-enter the regime until 30 June 2024.

Business

Clean building withholding tax concession

The Government will expand the Clean Building Managed Investment Trust (MIT) withholding tax concession to include data centres and warehouses. This applies if the buildings meet the required energy efficiency standards and are constructed after 7:30 pm AEST on 9 May 2023. The measure will come into effect from 1 July 2025.

In addition, Labor is proposing to increase the minimum energy efficiency rating for clean buildings, both new and existing, to a 6-star rating. They are consulting on how to transition existing buildings to this new rating.

Built-to-Rent initiatives.

The Government has launched two new programs to encourage the development of build-to-rent projects to address the housing supply and affordability issues.

The first initiative raises the depreciation rate for capital works tax deductions from 2.5% to 4% per year, which means that eligible build-to-rent projects will be fully depreciated over 25 years instead of 40.

The second initiative reduces the final withholding tax rate on eligible fund payments from management investment trusts investments from 30% to 15%.

GST Compliance Program

The Government has decided to extend its enhanced GST Compliance Program until 2026-2027. The program aims to ensure that businesses accurately record their GST liabilities and claim GST refunds correctly. The ATO will be allocated $588.8m in funding to continue the program, which is expected to generate $3.8b in net GST revenue. Some of this funding will be used to develop advanced data analysis tools to tackle high-risk areas related to GST. This extension is particularly significant for small and medium-sized businesses, which will need to invest more resources into their accounting systems to comply with GST regulations.

Petroleum Resource Rent Tax Cap

In response to the review of the Petroleum Resource Rent Tax (PRRT), the Government is proposing several changes to the tax. The PRRT is levied at 40% on taxable profit derived from an interest in a petroleum project.

One of the changes proposed is a cap on deductible expenditure used to offset assessable PRRT income for each liquefied natural gas (LNG) project. The cap will be 90% of PRRT assessable receipts. However, the cap will not apply to LNG projects until the later of either seven years after the first year of production or 1 July 2023. Expenditure that cannot be deducted due to the cap will be carried forward and uplifted at the Government long-term bond rate.

Further consultation will be conducted on other potential changes to the PRRT. These changes aim to ensure that the PRRT effectively captures economic rents associated with the exploitation of petroleum resources.

Financial Crime & Tax Avoidance

The Australian Government has announced plans to merge the Serious Financial Crime Taskforce (SFCT) and the Serious Organised Crime (SOC) program, effective from 1 July 2023. The merged SFCT will receive funding for an additional four years until 30 June 2027.

The SFCT, established by the Australian Taxation Office (ATO), aims to combat serious financial crimes that negatively impact the tax and superannuation systems, including offshore tax evasion, illegal phoenix activities, and cybercrime. The SOC program, on the other hand, targets the production and trade of illicit goods, such as firearms and drugs, as well as money laundering activities that distort financial markets.

By merging these programs, the government seeks to enhance the disruption of organized crime groups that pose a threat to Australia’s public finances and financial integrity.

15% Minimum rate of tax on large multi national groups

From 1 January 2024, large multinational groups with global revenue of A$1.2 billion or more will face a 15% minimum tax rate in Australia. The government plans to achieve this through two key measures.

Firstly, Australian parent entities of these large groups will be subject to a top-up tax in Australia for income years starting on or after 1 January 2024 if their global income is subject to an effective tax rate of 15% or less.

Secondly, starting on or after 1 January 2025, this rule will be expanded to include Australian subsidiaries of large multinational groups. They will face a top-up tax in Australia on global income if no other country has imposed a top-up tax to ensure that all global income is effectively taxed at 15% or more.

Furthermore, Australia will also impose a top-up tax on any Australian income that has an effective tax rate of less than 15%.

These measures are Australia’s response to the OECD/G20’s ‘Pillar II’ recommendations, which aim to address potential underpayment of tax caused by the ‘digitalisation’ of the economy.

Tax Integrity

Franked Distributions funded by Capital raisings

In the 2023 budget, a measure called Tax Integrity – Franked Distributions Funded by Capital Raisings has been revised to apply to distributions made on or after 15 September 2022. This measure targets specific arrangements where a company raises new capital and simultaneously makes franked distributions to shareholders, resulting in depleted franking accounts. The ATO has previously raised concerns about this arrangement, and the measure prevents companies from attaching franking credits to shareholder distributions where it applies.

Expanding the general anti-avoidance rule in the income tax law

In the 2023 budget, a measure called Tax Integrity – Franked Distributions Funded by Capital Raisings has been revised to apply to distributions made on or after 15 September 2022. This measure targets specific arrangements where a company raises new capital and simultaneously makes franked distributions to shareholders, resulting in depleted franking accounts. The ATO has previously raised concerns about this arrangement, and the measure prevents companies from attaching franking credits to shareholder distributions where it applies.

Technology Grants

Industry Growth Program

Australia has announced a new Industry Growth Program worth $392.4 million that aims to help small to medium-sized enterprises and startups commercialise their ideas and grow their businesses. It replaces the Accelerating Commercialisation program, which provided SME businesses with up to $2 million in matched funding to commercialize their products or projects. The program is expected to target industries such as renewables, low emissions technologies, medical science, transport, agriculture, resources, and defense. However, more information about the program is yet to be released.

Digital Games Tax Offset

The previous government announced plans for a 30% tax offset for digital games in May 2021, and the Labor Government confirmed in October 2022 that it will continue with the implementation of the tax offset. However, the budget did not mention the tax offset, which may indicate a delay in its implementation, even though the digital games sector is crucial for Australia’s global digital games production.

Critical technologies industries

The Australian government has allocated $101 million over five years starting from 2022-2023 to promote the growth of quantum computing and artificial intelligence technologies. This will be achieved through the Critical Technologies Program, which includes extending the National AI Centre and providing support to small and medium-sized enterprises to adopt AI.

Superannuation

Reduction of Superannuation concessions

Starting from July 1st, 2025, the Australian government will reduce tax concessions for individuals whose total superannuation balance exceeds $3 million. If an individual’s balance exceeds this amount at the end of a financial year, an additional tax rate of 15% will be applied to the proportion of their balance that exceeds $3 million, including notional (unrealised) gains and losses. Balances below $3 million will continue to be taxed at 15% or less. The government announced these changes in February 2023 and has emphasized that defined benefit schemes will be properly valued and taxed accordingly.

Increasing the payment frequency of employer Superannuation Guarantee contribution

Starting from 1 July 2026, employers will be required to pay their employees’ Superannuation Guarantee entitlements on the same day they pay their salaries and wages. At present, these liabilities are payable on a quarterly basis and not in line with the frequency of salary and wage payments. These changes are expected to improve employee visibility of superannuation payments and enable the ATO to monitor superannuation non-compliance in real-time.

Superannuation Guarantee set to increase to 12%

As per previous legislation, the Superannuation Guarantee rate is set to increase from the current rate of 10.5% to 11% starting from July 1, 2023. This rate will further increase to 11.5% from July 1, 2024, and finally to 12% from July 1, 2025.

Amending the non-arm’s length income (NALI) rules

The rules for non-arm’s length income (NALI) in superannuation funds will change. The NALI for general expenses will be limited to twice the level of a general expense. If income is deemed NALI, it is taxed at the highest marginal tax rate of 45% instead of the concessional rate of 15% or less. This change is a response to the previous extension of NALI rules in 2018, which had the potential to affect all income of a superannuation fund where certain general expenses had enough connection to the income. The new rules will cap NALI to an upper limit of double the value of the general expense, valued at an arm’s length price. Large APRA regulated funds will be exempt from these provisions for both general and specific expenses, and expenditure that occurred before 1 July 2018 will also be exempted.

Individuals

Medicare levy low-income thresholds

Starting from 1 July 2022, the low-income thresholds for the Medicare levy will be adjusted for singles, families, seniors, and pensioners to reflect changes in the CPI.

The new thresholds are listed below:

The family income thresholds will see an increase of $3,760 for each dependent child or student, up from the previous amount of $3,619.

Lump sum payments in arrears exempted from Medicare Levy

Starting on 1 July 2024, lump sum payments in arrears that meet certain criteria will be exempt from the Medicare Levy. To be eligible, taxpayers must have qualified for a Medicare levy reduction in the two years prior to when the lump sum is accrued. They must also meet the existing requirements for the lump sum payment in arrears tax offset, which includes receiving a lump sum payment that is at least 10% of their income in the year of receipt.

Extending the personal income tax compliance program

The Australian Government has allocated $89.6 million to the Australian Taxation Office (ATO) and $1.2 million to Treasury to extend the personal income tax compliance program for two years, starting from 1 July 2025. This extension is aimed at enabling the ATO to closely monitor areas of non-compliance and manage emerging risks by offering various measures to encourage tax compliance. As a result, it is anticipated that these measures will boost receipts and payments by $474.9 million and $90.8 million respectively over the period of five years starting from 2022-23.

Energy Price Relief Plan

The Government has unveiled a $1.5 billion energy plan spanning five years, starting from 2022-23, which aims to mitigate the effects of increasing energy prices on Australian households and businesses. The program will offer targeted energy bill relief and progress gas market reforms.

As part of the initiative, a $1.5 billion Energy Bill Relief Fund will be established over two years, commencing from 2023-24, to provide specific energy bill relief to qualified households and small business customers, including pensioners, Commonwealth Seniors Health Card holders, Family Tax Benefit A and B recipients, and small business customers of electricity retailers.

Additionally, the Australian Competition and Consumer Commission and the Australian Energy Regulator will receive funding under the scheme.

Household energy upgrades fund – establishment

To promote energy-efficient home improvements and encourage energy savings, the Government has allocated $1.3 billion to establish the Household Energy Upgrades Fund.

Under the scheme, $1 billion in funding will be provided to the Clean Energy Finance Corporation to offer low-cost finance and mortgages in collaboration with private financial institutions for home upgrades aimed at reducing energy consumption. In addition, $300 million will be set aside in a Contingency Reserve over four years from 2023-24 to support energy-saving upgrades to social housing, in partnership with states and territories.

Existing reductions in tax rates – Stage 3

The Personal Income Tax Plan (PITP) remains unchanged in this Budget, and will continue to deliver tax relief in future years as previously legislated.

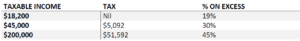

From 1 July 2024, Stage 3 of the PITP will commence, with 95% of individual taxpayers being assessed at a marginal rate of 30% or less. The tax rates for Stage 3 are as follows:

Cessation of low to medium income tax offset

As of 30 June 2022, the Low and Middle Income Tax Offset (LMITO) of up to $1,500 has ceased. The previous Coalition Government announced the cessation in the March 2022 Federal Budget, and there were no announcements in this Budget to reinstate the offset.

The LMITO was introduced as a COVID-19 pandemic response measure and was available to individuals with taxable incomes between $48,000 and $126,000.