COVID 19 Lockdown support for Businesses

State & Federal Government COVID 19 Support

The NSW State & Federal Governments have released information about support available to businesses if a lockdown extends for 4 weeks or more. The support packages available are:

- Grants of up to $15,000 available through the expanded 2021 COVID-19 business grants program

- Cashflow support of up to $10,000 per week

- $1,500 Micro Business Grants

- Deferral of Payroll Tax & a 25% payroll tax waiver

- Eviction Moratorium, Rent Protection & Grants

If you would like to apply or register your interest for any of the above grants it is important to ensure that your Business & contact details are correct on the Australian Business Register & your personal & business information is correct and you have a MyServiceNSW account with a business profile

2021 COVID-19 Business Grant – Up to $15,000

The small business grant has been increased up to $15,000 and expanded to eligible business with annual wages of up to $10,000,000. This grant is also available to sole traders & not for profit organisations.

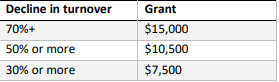

The impact the lockdown has on your turnover determines the amount of the grant available to you. You will need to provide supporting evidence that shows the decline in turnover over a minimum 2 week period after the lockdown commenced.

Eligibility

The eligibility criteria and the application of the decline in turnover test has not yet been determined. We will keep you updated as more information is released.

How to Apply

Applications open on the 19th of July through ServiceNSW

Up to $10,000 cashflow Support

Cashflow support of between $1,500 & $10,000 is available to businesses. The amount of cashflow support you receive is based upon 40% of the NSW payroll payments made by your business. this include not-for-profit organisations.

If you do not have employees or are a sole trader and you meet the eligibility criteria you will access to cashflow support of $1,000 per week.

The cashflow support will end when the Commonwealth hotspot declaration is removed or when lockdown restrictions are eased back.

Eligibility

- Demonstrate a 30% decline in turnover

- Keep you current staffing levels as of the 13th of July 2021. This includes full time, part time & long term casuals.

- Annual turnover between $75,000 & $50 million

- Impacted by the Greater Sydney COVID-19 restrictions

The eligibility criteria and the application of the decline in turnover test has not yet been determined.

How to apply

Applications are not yet open for the Cashflow support payment. You can register your interest from 14th July 2021 through ServiceNSW

Micro Business Grants – $1,500 per fortnight

$1,500 per fortnight is available to micro businesses impacted by the current Greater Sydney COVID-19 restrictions. This grant is also available to sole traders. The grants are available from week one of the lockdown until restrictions are eased.

Eligibility

- Demonstrate a 30% decline in turnover

- Annual turnover of mare than $30,000 and less than $75,000

- Impacted by the current COVID-19 restrictions in Greater Sydney

How to apply

Applications are not yet open for the Micro Business Grant. You can register your interest from 14th July 2021 through ServiceNSW

Payroll Tax Relief

Payroll Tax & lodgement deadline deferred

The July & August 2021 NSW payroll tax due date has been deferred to 7th of October 2021. The due date for the annual reconciliation for 2020 – 2021 has also been deferred until 7th of October 2021.

Payment arrangements & previous payroll tax deferrals due in July 2021 have NOT been deferred.

25% payroll tax waiver for businesses with Australian wages between $1.2million & $10million

If you have experienced a 30% decline in turnover and have paid wages between $1.2million & $10million you may be entitled to the 25% payroll tax waiver for 2021-2022. More information is to be released by the end of August from RevenueNSW

Eviction Moratorium

Legislative amendments are being introduced for residential tenants who fall in to rental arrears and have suffered a loss of income of 25% due to the current COVID-19 lockdown in Greater Sydney and meet certain other requirements.

Commercial & retail landlords are encouraged to attempt mediation before evicting a tenant impacted by the Public Health Orders.

Land Tax Relief

Commercial, retail & residential landlords will be entitled to land tax relief if you provided a rent reduction to tenants in financial crisis. The value of the relief is equal to the amount of rent reductions you provided to your tenant.